The increase in the average listing price was mostly due to a mix shift, with more 0- and 2-year-old vehicles being sold. Retail used-vehicle prices have been consistently lower through the first nine months of 2024 than year-ago levels.

Used-vehicle inventory levels at the start of October were lower than in September, according to a Cox Automotive analysis of vAuto Live Market View data released Oct. 18,

As October opened, the total supply of used vehicles on dealer lots — franchised and independent — across the U.S. was 2.15 million units, down 4% from a year ago and from the 2.18 million units at the start of September.

Meanwhile, retail used-vehicle sales in September decreased by 9% compared month-to-month with August figures, as shown by the vAuto Live Market View data estimates. About 1.4 million used vehicles were sold at retail — from franchised and independent dealers — during September, a 5% year-over-year increase. Days’ supply of used vehicles at the end of September was 47, up from a revised 45 days at the end of August.

While sales had been trending down slightly in the first half of September, Hurricane Helene most likely impacted sales toward the end of the month. Retail used-vehicle sales of 1.38 million vehicles in September were 9% below the 1.51 million reported for the month of August. Still, used-vehicle sales were healthy last month and higher year over year by 5%.

“Similar to the previous two years, estimated retail sales for used vehicles moved lower in September,” said Scott Vanner, senior analyst of economic and industry insights at Cox Automotive, in a news release. “The certified pre-owned segment, in particular, fell much more than the overall used market. Additionally, adverse weather may have contributed to a sharper decline in month-end sales this year, making the decrease more pronounced than it might have been otherwise.”

The retail used-vehicle sales estimates are based on observed unit changes tracked by vAuto, an inventory management company.

Used Vehicle Listing Prices Up

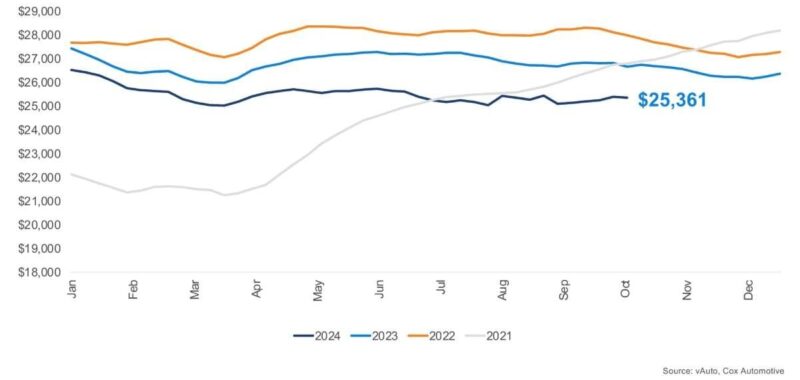

The average used-vehicle listing price was $25,361, up from the revised $25,135 at the start of September and now down 5% from a year earlier. The increase in the average listing price was mostly due to a mix shift, with more 0- and 2-year-old vehicles being sold. Retail used-vehicle prices have been consistently lower through the first nine months of 2024 than year-ago levels.

Affordability remains challenging for consumers, and supply is more constrained at lower prices. Used cars below $15,000 continue to show low availability, with only 33 days’ supply, four days lower than last year and 29% less than the industry average. The top five sellers of the month were listed at an average price of $23,759, about 6% below the average listing price for all vehicles sold. Once again, Ford, Chevrolet, Toyota, Honda, and Nissan were the top-selling brands, accounting for 51% of all used vehicles sold.

CPO Sales Drop in September, Partly Due to Fewer Selling Days

Both overall retail used-vehicle sales and sales of certified pre-owned (CPO) vehicles decreased month over month in September, according to data reviewed by Cox Automotive. However, CPO sales in September were down 20.8% year over year, or 48,000 fewer units. In addition to fewer selling days, this decrease is likely due to the lack of supply of off-lease and trade-in units. Last month’s CPO sales are now estimated at 182,551, a drop from 235,150 in August, marking a 22.4% decline. The year-to-date total CPO sales volume is 4.2% lower than last year. Cox Automotive’s year-end forecast for CPO remains steady at 2.6 million, with a minor surge expected at year-end.