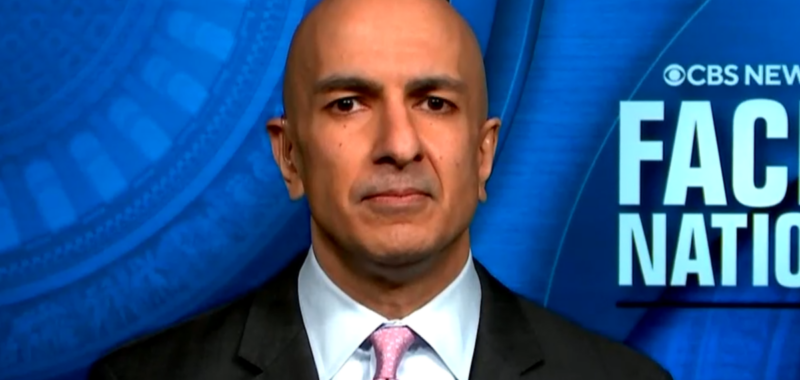

The following is the transcript of an interview with Neel Kashkari, the president of the Federal Reserve Bank of Minneapolis, that aired on “Face the Nation with Margaret Brennan” on April 13, 2025.

MARGARET BRENNAN: We go now to Neel Kashkari, the president of the Federal Reserve Bank of Minneapolis. Welcome back to Face the Nation.

NEEL KASHKARI: Thank you.

MARGARET BRENNAN: We checked and we saw soybeans are Minnesota’s largest export, something like 2 billion annually. A lot of those soybeans go to China. Do you have a sense yet of what the sustained trade war with China would cost farmers in the midsection of the country?

KASHKARI: Well, it’s funny you said that. I just heard from an ag Leader two days ago in Minnesota who said that even if there’s a 10% tariff from China on soybeans, zero Minnesota soybeans will go to China because it’s a competitive global market, it’s a commodity. They will have to go someplace else. And so in many sectors, whether it’s a 10% tariff or 50% or 100% tariff, it has dramatic effect on the trade flows. And so a lot of my folks that I hear from here are quite concerned about it.

MARGARET BRENNAN: Yep, Bloomberg was already reporting that China was purchasing soybeans from Brazil. So looking to other suppliers, potentially. I want to ask you more broadly, beyond your state, you said on CNBC this past week, investors may now be saying America is no longer the most attractive place in the world to invest. What makes you say that?

KASHKARI: Well, we have to start at what causes a trade deficit. It’s just economic math that if investors around the world say one country is the best place to invest, the math works out that that country will have a trade deficit. And part of how that shows up for that economy is interest rates will be lower across the economy because investors are investing and bringing their money into that economy. So now, if we’re not going to have a trade deficit going forward, then investors must conclude that there are other attractive places to invest too. And as we see yields go up, we’re seeing the treasury yields go up. The reason the Fed cares about this is we have to make sure that it’s not inflation that’s driving those yields up. It could be that investors are saying, ‘Hey, there are other places we also want to invest.’ That it won’t just be everybody wants to pour money in America. So these are very complicated details to sort out. The Fed’s job is to keep inflation under control and not let it get unanchored.

MARGARET BRENNAN: So people typically think of US Treasuries as the safe thing to buy in a crisis, because they’re backed by the full faith and credit of the U.S. government. So when the President says the bond markets got queasy, and that was part of his decision in delaying these reciprocal tariffs, what does that say to you? How do you interpret that the bond market got spooked like it did?

KASHKARI: Well, I think investors in the US and around the world are trying to determine what is the new normal in America. You know, I saw an interview on Friday where Blackrock CEO Larry Fink speculated that maybe the 10 year treasury would go to a 5% yield. He just offered it as a possibility. We don’t know where that new normal level is going to be, and we at the Fed have no ability, zero ability, to affect that destination. And I think markets are searching for where are these trade negotiations going to end up. Ultimately, that destination, whether it’s a 5% treasury or 4 or something else, that’s 100% determined by trade policy and fiscal policy. And I think there’s a lot of uncertainty in the markets about what is that new destination, and we’re going to have to watch and see and at the Fed. Our job is to keep inflation under control so that rate isn’t even higher.

MARGARET BRENNAN: Right. And just for our audience, when what yields going up indicates people are selling treasuries. And when Larry Fink, who I believe is the world’s largest asset manager, spoke, he said something about the Fed might not have the ability to do any real easings. Is that what, what concerned you?

KASHKARI: Well, it’s not a concern. It’s just a recognition of the tools that we have. So we at the Fed, we can manage kind of near term ups and downs in the economy, but ultimately, where the economy settles in the long run as a result of all of these renegotiations and these new trade flows and fiscal policy, that new normal is completely out of the central bank’s control. We cannot affect that. All we can do is keep inflation expectations anchored and try to manage some of the ups and downs on that journey, but that destination is up to the executive branch and Congress, not the Fed.

MARGARET BRENNAN: So the tariffs on things like steel and lumber and all the things you use to build a building in the house, those may raise prices. Shelter already was a big contributor to the inflation rate. If, what does all this add up to? Do you have any expectations? It certainly sounds like the trajectory is prices going up.

KASHKARI: Well there’s no question that tariffs, by themselves, are inflationary. They push prices up, just as you articulated. The question is, is it a one time increase in prices and then prices grow slowly from there, or is it something more sustained and ongoing? And it’s the Fed’s job to make sure that it’s only a one time adjustment in prices and nothing longer term than that. So that’s the part that we have a role to play here, and we’re committed to doing so. But you’re right. Tariffs push up prices and push down economic activity, and that’s a challenging situation because the Fed simply does not have the tools to undo the economic effects of tariffs in a trade war. We can just keep inflation from getting out of hand.

MARGARET BRENNAN: And you don’t meet again until what, May 7?

KASHKARI: In a few weeks, we meet. But obviously we are continuing to monitor all the economic data. The economy was fundamentally very healthy, January, February, March. The job market has been strong. The underlying inflationary dynamics have been coming down, just as we hoped for and we’ve been trying to engineer. But obviously this is the biggest in the last month or so, this is the biggest hit to confidence that I can recall in the 10 years that I’ve been at the Fed, except for March of 2020 when COVID first hit. So when there’s that type of hit to confidence, it can have large effects on the economy, and we’re monitoring that very carefully through the data and through all of our discussions with businesses all around the country.

MARGARET BRENNAN: Yeah. JP Morgan CEO Jamie Dimon said the odds of recession are now 50/50. Goldman Sachs says 45% chance of recession. Is the risk that high in your estimate?

KASHKARI: You know it’s really going to be determined by are there quick resolutions? To your prior guests. Are there quick resolutions to these trade uncertainties with our major trading partners? The faster those resolutions come, I think the more that confidence can be restored, and hopefully those odds can be brought down. But it is a serious situation if everybody gets nervous at the same time, businesses and consumers, and they all pull back at the same time that can lead to an economic downturn just by itself. Setting aside the math of what the tariffs end up doing to prices. And so there’s a lot to try to unwrap right now, and we’re doing our best to try to keep our arms around it.

MARGARET BRENNAN: But the financial markets look orderly to you at this point?

KASHKARI: They are. I mean, obviously the market participants are trying to grasp for where is this all going to settle, and that’s causing volatility as they’re, as they’re trying to do these assessments. So that volatility is to be expected, but markets are functioning, transactions are happening, and so I anticipate that’s going to continue.

MARGARET BRENNAN: All right. Neel Kashkari, always good to get your insights. Thank you for joining us. We’ll be right back with more. Face the Nation.