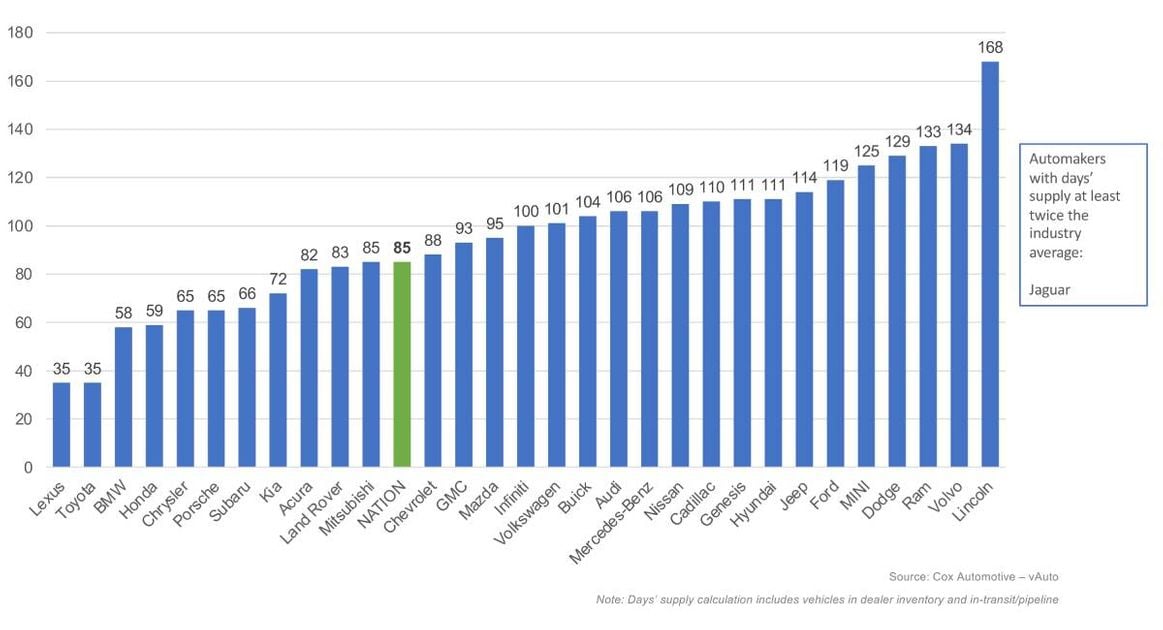

Toyota and Lexus, the perennial “tight supply” brands, continue to move vehicles quickly compared to most others. Importantly, Stellantis has succeeded in trimming inventory among its core brands and, in the latest measure, is no longer posting record days’ supply at or above twice the industry average.

October vehicle sales in the automotive industry increased 13% over the same time last year, yet new-vehicle inventory continues to rise.

The election is over and decisive. Consumer sentiment has improved for five straight months and is at the highest level in three and a half years, according to Morning Consult.

So as the year winds down, the automotive market is seeing some interesting trends. Inventory levels and incentives are rising. Days’ supply has reached the highest days’ supply in two years. It’s a bit of a balancing act for automakers as they try to maintain discipline.

At the end of October, the total U.S. supply of available unsold new vehicles reached north of three million for the first time since the pandemic, up 29% year over year, according to an analysis of vAuto Live Market View data. With 3.04 million units available, the days’ supply increased to 85 days, which is now 14% higher compared to the same time last year.

As automakers and dealers continue to purge older metal and work to keep inventory of current model-year vehicles down, holiday bells are already ringing with seasonal discounts. Still, most automakers saw a days’ supply increase in the latest measure.

Toyota and Lexus, the perennial “tight supply” brands, continue to move vehicles quickly compared to most others. Importantly, Stellantis has succeeded in trimming inventory among its core brands and, in the latest measure, is no longer posting record days’ supply at or above twice the industry average. Ram and Jeep saw notable decreases in days’ supply, fueled partly by higher incentives.

New-Vehicle Prices Remain Persistently High

The latest report showed that the average listing price for a new vehicle was $48,117, up 0.7% from a month earlier and up 1.8% compared to last year. New vehicle price inflation has leveled, but average vehicle listing prices have stubbornly remained above $47,000 for more than two years with no relief. If the price trends of the winter of 2023 stick, expect prices to stay elevated through early 2025.

The average transaction price (ATP) of a new vehicle in the U.S. in October, reported earlier this week, was $48,398, up $78 from the month prior and higher year over year by 1.7%, according to Kelley Blue Book. High-priced luxury vehicles have been incentivized the heaviest of late and also have the highest days’ supply. Vehicles priced between $50,000 – $80,000 are averaging days’ supply of 100 days’ supply. Incentives in this category are well above the industry average, nearing 10% of ATP.

In October, industry-average incentive spending rose to 7.7% of ATP ($3,708), up from 7.2% in September and well above the 4.7% reported one year ago. In 2019, the average monthly incentive was just $176 higher, representing 10.1% of the average transaction price. With the holiday season pending, more incentives and discounts are expected to spur rising consumer demand and deliver positive momentum in retail showrooms as inventory levels creep higher.