Launched at the beginning of April, Fregenal said he believes the new program will result in better financial performance per transaction. About 120 agents signed up through an internal soft launch. Elevate includes assistance with marketing, lead generation, coaching and recruiting.

“I think we can see gross profit margin grow by three to four times compared to our traditional gross profit margin, and it’s really because of the efficiency of our platform,” he said. “We want to be careful about the growth. It is a complex program, and so we want to make sure that we are firing on all cylinders, but we think that by the end of the year, we can be at about 100 new agents a month.”

Fathom doesn’t appear to be having trouble attracting new agents. The brokerage hit 14,715 agents in the first quarter of 2025, a 22.8% year-over-year increase. That’s the firm’s highest annual increase since hitting 28% in the fourth quarter of 2022.

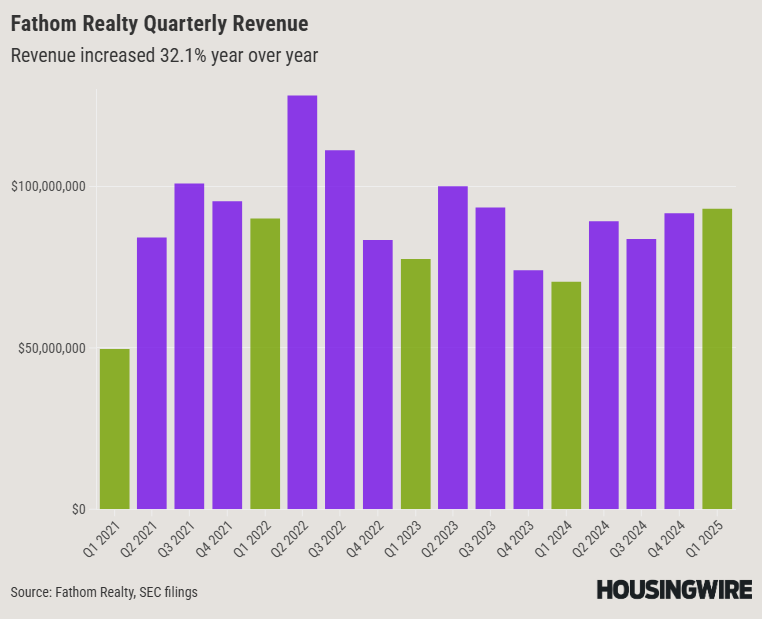

The additions are helping drive revenue, which grew to $93.1 million from January to March, a 32.1% annual gain and Fathom’s highest total since the third quarter of 2023.

But the gains in agent count and revenue aren’t helping Fathom’s bottom line. The brokerage tallied a net loss of $5.7 million in Q1 2025, roughly in line with the $5.9 million loss during the opening quarter of 2024.

More concerning is that the net loss for the company’s operating cash flow grew from $947,000 in the first quarter of 2024 to $5.7 million a year later.

The company’s brokerage revenue increased from $65.4 million in Q1 2024 to $88.9 million in Q1 2025, but Fathom’s ancillary services are still bringing in modest amounts.

Its mortgage division revenue jumped by $300,000 to $2.6 million, its technology revenue stayed flat at $1.1 million and title brought in $1 million.