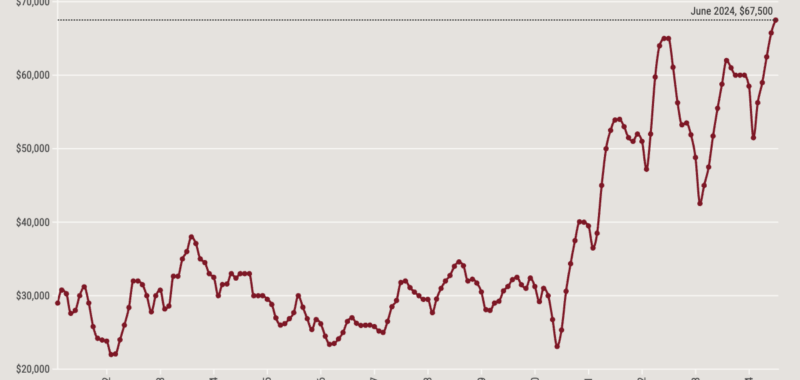

The typical down payment for U.S. homebuyers soared to a record high of $67,500 in June, up nearly 15% from $58,788 a year earlier, according to a new report from Redfin.

The increase in down payments came despite a slowdown in home price growth (4%). Redfin economists attributed it to the quirks of the current market, where higher-priced, turnkey homes in desirable neighborhoods are more likely to sell.

They also noted that buyers are putting down a higher percentage of the purchase price to lower their monthly mortgage payment. And buyers also had more equity from their home sales, which gives them more cushion.

The typical homebuyer’s down payment was 18.6% of the purchase price in June, the highest level observed in over a decade and up from 15% a year earlier, Redfin said Wednesday. Overall, nearly 60% homebuyers put down more than 10% of the purchase price in June, up from 56.6% in June 2023.

Down payments by metro

No metro in America had a bigger increase in median down payments than Newark, New Jersey, where it jumped to $125,000 from $82,500 a year ago. That’s a 51.5% increase, and it’s perhaps not surprising when considering the amount of wealth flowing out of New York City and into the tony suburbs surrounding Newark.

The Newark metro area was followed by Las Vegas (up 40.7% to $45,500 from $32,328), Washington, D.C. (up 38.7% to $76,000 from $54,800), New Brunswick, New Jersey (up 32.7% to $124,213 from $93,625) and Nashville, Tennessee (up 32% to $61,395 from $46,500).

Down payments only fell in three metros: Jacksonville, FL (down 28.4% to $28,338 from $39,950), Oakland, CA (down 11% to $195,000 from $219,000) and Tampa, FL (down 6.4% to $39,773 from $42,500).

Metros with highest/lowest down payments, in percentages

In San Francisco, the median down payment was equal to 25.8% of the purchase price—the highest among the metros Redfin analyzed. San Francisco was followed by fellow California metros of San Jose (25.7%) and Anaheim (25%).

Down payment percentages were lowest in Virginia Beach, Florida (3%)—an area with a higher concentration of veterans using VA loans with little to no down payment—followed by Detroit (6.8%), and Jacksonville, Florida (8.6%).

All-cash purchases on the rise

The percentage of U.S. home purchases made with all cash rose to 30.7% in June, up slightly from 30.4% a year ago, Redfin economists found.

“The percentage of all-cash sales generally follows the same trend as the rise and fall of mortgage rates. When rates are down, the percentage of all-cash sales is down too, and the opposite is true when rates go up,” said Redfin Senior Economist Sheharyar Bokhari. “That means we may start to see all-cash purchases level off a little now that mortgage rates have started to come down from recent highs.”

The most common areas for cash purchases were West Palm Beach, Florida (50.4%), Riverside, California (39.9%) and Detroit (38.9%), according to Redfin. All-cash deals were comparatively rare in the expensive metros of San Jose, California (18.3%), Seattle (21%), and Oakland (21.2%).

Somewhat surprisingly, Pittsburgh had the largest increase in homes purchased with cash at 28.6%, up from 19.2% earlier. That was followed by the New Brunswick, New Jersey metro (up to 36.8% from 31.1%) and Newark, New Jersey (31.6% from 25.9%).

In Providence, Rhode Island, just 23.1% of home purchases were made in cash, down from 33.5% a year earlier—the lowest increase among the metros Redfin analyzed. Baltimore (down from 36.1% to 26.8%) and Jacksonville, Florida (down from 44.2% to 38.1%) followed.