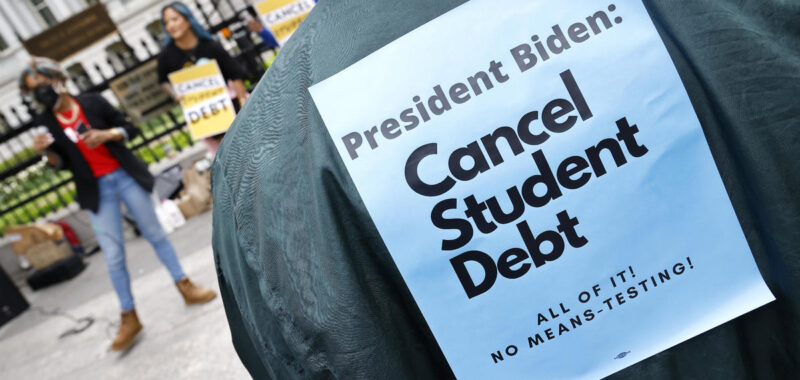

The Biden administration’s efforts to erase student debt for the 46 million Americans who are carrying college loans have repeatedly hit legal roadblocks. Now, the Department of Education is rolling out a new plan that could provide debt relief to 8 million borrowers who are suffering from financial hardships.

The new plan, unveiled Friday, would provide loan relief for approximately 8 million people with student loans who are suffering financial distress caused by other debts, ranging from medical expenses to costs due to a natural disaster. The Education Department said the proposed rules will be published in the Federal Register in the next few weeks, and that it expects to finalize the regulations in 2025.

President Joe Biden made delivering debt relief to people with student loans a key policy issue of his 2020 campaign, but Republican-led states have sued to block many of those efforts, while the Supreme Court in 2023 ruled 6-3 against his plan to erase up to $20,000 in debt for millions of borrowers.

At the same time, Americans are holding more than $1.7 trillion in student loans, a debt load that has impaired their ability to save or buy a home, among other issues.

“For far too long, our student loan system has made it too difficult for borrowers experiencing hardships, often financial hardships, to access relief,” Education Department Miguel Cardona said on a call with reporters. “It’s not fair, it’s not right and it’s not who we are as Americans.”

How people would get relief

Under the proposal, there would be two ways borrowers could qualify for the debt relief. Some people with student loans could receive forgiveness without an application, with the Education Secretary providing one-time relief to borrowers whom the agency determines have an 80% chance of being in default within two years, Cardona said.

“A big reason why we’re fighting for student debt relief is to address the more than 1 million defaults we see annually in the student loan system,” he said.

The second pathway for loan relief would provide forgiveness after borrowers fill out an application, with the department assessing 17 factors such as the applicant’s overall debt balance, household income, and whether their student loan payments are keeping them from affording basics like housing or health care.

“Financing a college education is supposed to help students climb the economic ladder, not leave them buried in a ditch,” Cardona said.